2: Special Performers

Of course one of the great aspects of technology investing is that some truly spectacular returns can be made from time to time. Occasionally a multi-bagger will be massively successful for subscribers, particularly if we can be a patient holder over time.

One recent example is Instem, which received a bid in autumn 2023 at 833p per share. We originally made Instem a new buy in the September 2013 newsletter at 92.5p, making the gain just over 800% at the takeover price.

Now we’ve picked this extraordinary performer to demonstrate the unique potential of technology shares, but this gain is not intended to be representative. Of course many other recommendations have not performed so well, and some have fallen in value.

3: The New Year Tips

Every January we make our special selections for the year, reviewing them in the December newsletter. We can’t win every year, but over the years we have a very strong track record from our annual tips.

3: The North American Tips

Whilst the newsletter is generally devoted to smaller UK shares, we also provide some coverage of the larger North American market, as there are so many great technology opportunities there. In 2023 our North American tips performed very well and posted an average gain of 24.42% for the 11 months to December 2023. In early 2024 our North American tips have. continued to outperform our UK recommendations.

We think that’s a more comprehensive track record than many newsletters would provide, but we fully recognise that the proof of the pudding is in the eating, and that the newsletter must deliver profitable advice for subscribers to justify our annual fee. We hope that this data will give you sufficient confidence to give the newsletter a try.

OUR PERFORMANCE RECORD

Please bear in mind that historic performance is not necessarily a guide to the future. Nevertheless, we are proud of the newsletter’s strong performance record, which has helped a large number of investors to achieve strong returns from their technology stock portfolios.

The performance record has four distinct elements.

1: The Techinvest Trader Portfolio

Now in its fifth incarnation, the Trader Portfolio is an unaudited paper fund that is run to illustrate the dynamics of managing an active technology sector portfolio. No new share goes into the portfolio until after it has been rated as a ‘New Buy’ in an issue of Techinvest. After that, the fund can act just like any subscriber, using its judgement to buy, hold or sell in accordance with subsequent price movements and news flow within the sector.

All transactions take full account of prevailing bid-offer spreads. Commission is charged at a flat rate of £9.95 on deals of any size, to reflect current online dealing rates. No credit is taken for dividends paid by companies nor for interest on cash balances. Current holdings are valued using mid-market prices.

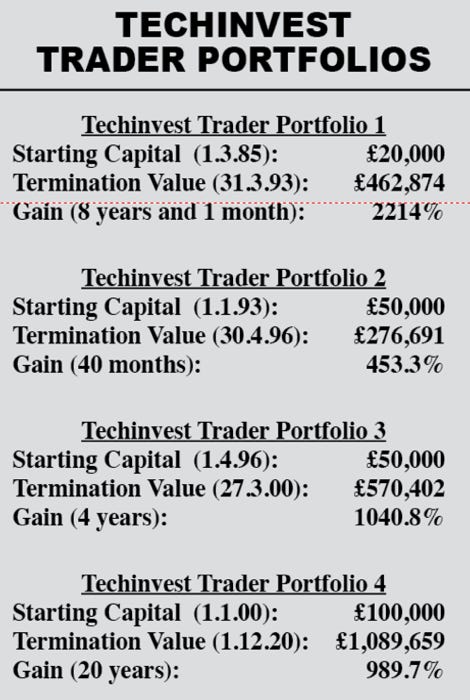

Let’s start with a long-term perspective and the performance of the first four Trader Portfolios (1985-1993; 1993-1996; 1996-2000; and 2000-2020):

Warning: the price and value of all shares may go down as well as up, and you may not get back the full amount invested. You should not buy equity securities with money you cannot afford to lose. Technology companies may exhibit greater than average volatility, meaning your investment may be subject to sudden and large falls in value and you may get back nothing at all. Changes in rates of exchange may have an adverse effect on the value or price of the investment in sterling terms. As with other investments, transactions in technology securities may also have tax consequences and on these you should consult your tax adviser. We have taken all reasonable care to ensure that all statements of fact and opinion contained in this publication are fair and accurate in all material respects. Investors should seek appropriate professional advice if any points are unclear. This newsletter is intended to give general advice only, and the investments mentioned are not necessarily suitable for any individual. It is possible that the officers of the McHattie Group and their associates may have a beneficial holding in any of the securities mentioned in this guide. Andrew McHattie is responsible for the preparation of the research recommendations contained within. Published by The McHattie Group, St Brandon's House, 40 Cornwallis Crescent, Bristol, BS8 4PH. Tel: 0117 407 0225. E-Mail: techinvest@mchattie.co.uk. Web Site: http://www.techinvest.co.uk. All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form by any means, electronic, mechanical, photographic, or otherwise without the prior permission of the copyright holder. ©2024. The McHattie Group is a media firm and offers restricted advice on certain types of investment only. Authorised and regulated by the Financial Conduct Authority.

Data and privacy policy: for subscribers and all enquiries, we will retain your data for the purpose of sending you our products, or details of our products, and we will retain those details indefinitely in order to offer you renewals, offers from our business, and any other products we think may be of interest to you. We will not sell or otherwise distribute your data to third parties. We take all reasonable precautions to ensure the security of personal data stored on our system, which is only accessible to staff of The McHattie Group. You should contact us if you wish your details to be removed from our database.